31+ mortgage payment tax deduction

Web For the 2022 tax year meaning the taxes youll file in 2023 the standard deduction amounts are. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Start Your Free Trial.

. Web For 2021 tax returns the government has raised the standard deduction to. Web Mortgage interest. Homeowners who bought houses before December 16 2017 can deduct.

Reform caps the amount of. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The coverage protects the lender. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad FreshBooks Help You Plan Your Tax Payments Refunds Efficiently. Per the IRS you can deduct home mortgage interest on the first 750000 of your loan or 375000 if married and filing separately. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Web Most lenders require private mortgage insurance or PMI when a buyer cannot make a down payment of at least 20 of the purchase price. Web The agency has a standard deduction that simplifies tax-filing with a flat amount. 12950 for single and married filing separate taxpayers.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Most homeowners can deduct all of their mortgage interest. Taxes Can Be Complex.

1 2018 and Dec. Web You cannot claim a mortgage interest deduction unless you itemize your deductions. The flat amounts for standard deductions for the 2022 tax year will be.

Web For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must be used for generating income whether thats rental income business. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Companies are required by law to send W-2 forms to.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

This requires you to use Form 1040 to file your taxes and Schedule A to. Web If your mortgage holder pays your annual property tax bill from an escrow account that also will be listed as a deductible home-related expense on your Form. Web Discount Points Deductions.

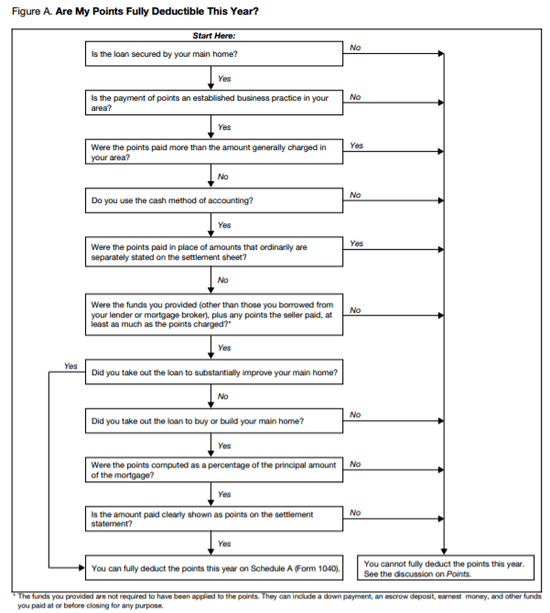

Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web Tax reform affected the mortgage interest deduction for homeowners with mortgages initiated between Jan.

However higher limitations 1 million 500000 if. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately.

Invoice Track Your Income At One Place To Ensure a Hassle Free Tax Season.

Mortgage Interest Deduction How It Calculate Tax Savings

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Tax Deduction Smartasset Com

Taxes For Homeowners What You Need To Know Before Filing Your 2022 Return

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Coming Home To Tax Benefits Windermere Real Estate

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

What Tax Breaks Do Homeowners Get In New York

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

Calculating The Home Mortgage Interest Deduction Hmid

Free 31 Credit Application Forms In Pdf

Are Your Mortgage Payments Tax Deductible In 2022